Central Bank Digital Currencies are in active development around the world. Central bankers and government officials are doing their best to champion the supposed merits of a digital national currency. But does anyone actually want a CBDC?

If your local jurisdiction were to put a CBDC to a vote, the heightened awareness and scrutiny would offset the prevailing information asymmetry between central planners and voters. It is unlikely that such a vote would pass.

So it will never be put to a vote.

Therefore, it is important to consider:

Why Central Bank Digital Currencies are being developed right now in 130 countries, representing 98% of global GDP.

Why they are a net-negative for society.

What is a CBDC?

Understand the fundamental characteristics of a Central Bank Digital Currency.

What does a CBDC enable?

The programmable nature of a CBDC will allow capabilities that are not feasible in the current fiat financial system.

The "financial inclusion" myth

"Our regulatory system is actively excluding people from access to finance. We have finally reached the point where access to basic financial services has become a privilege" - Andreas Antonopoulos

It has been a consistent talking point among central planners that a CBDC will promote financial inclusion.

But consider an era of accelerating fiat currency debasement combined with mandatory government identification, tighter lending conditions, increasingly arbitrary creditworthiness requirements and structurally higher interest rates.

When you consider these variables, does it become easier or harder for the unbanked or the under-banked to access formal financial services?

The inner workings of a CBDC

CBDC plumbing is constantly evolving, yet the objective remains the same - more control.

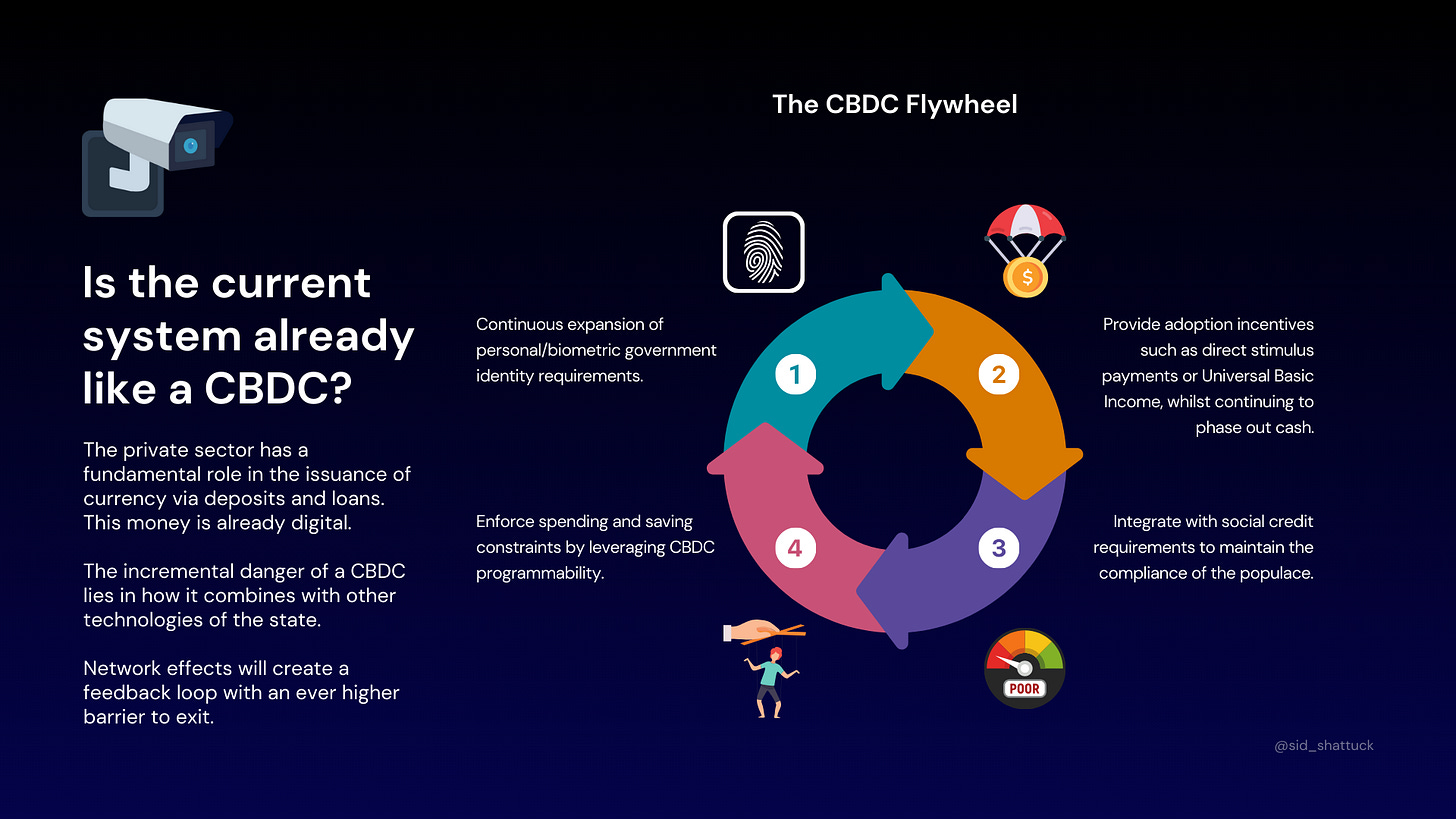

Is the current system already like a CBDC?

It is true that the majority of fiat money is digital. What makes a CBDC unique is not that it is inherently digital, but rather how it can be packaged with other tools of the state.

Agustin weighs in....

Couldn’t help myself with that one.

You don't need to take my word for it. Hear from the architects of out CBDC future.

How will a CBDC impact commercial banking

Familiarise yourself the basics of commercial banking and how a CBDC alters the incentives of the incumbent system.

Cause for optimism

Over the long arc of time, some theorise that CBDCs will be unsuccessful. Between now and then you should expect a period of increased economic volatility and concerted attempts at narrative control. Stay informed and seek out self-sovereign alternatives where possible.

Follow nation state CBDC progress and learn more with the Human Rights Foundation's CBDC tracker.

Thank you for reading.